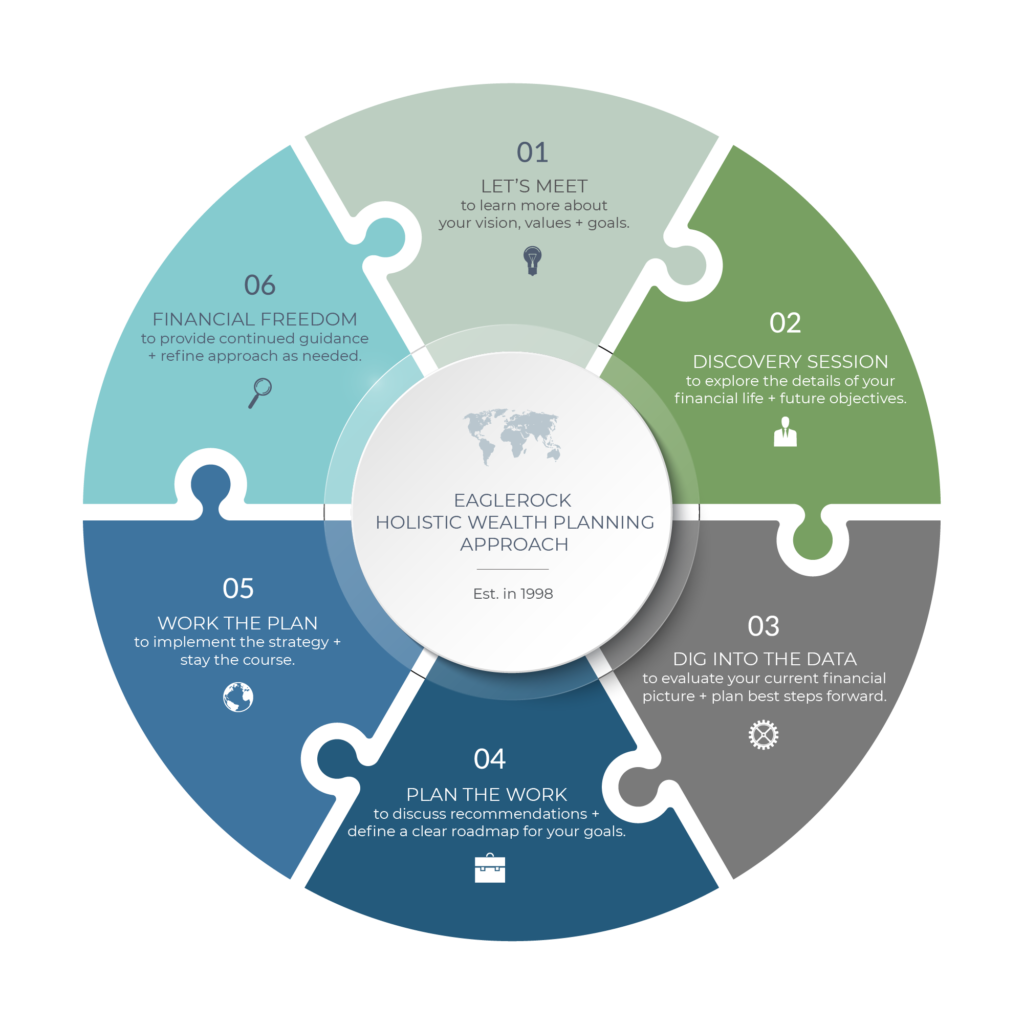

Our Approach.

Eaglerock Wealth Management is in the business of helping you live a more balanced, financially free life—saving and preparing for the future while enjoying and appreciating the present. Our 6-step wealth planning process provides a glimpse into each phase of our ongoing approach to help design and protect your wealth.

We Are Eaglerock.

Our holistic approach comes from serving the North Shore community for decades, putting clients first and caring about the wellbeing of every business owner, caregiver, and retiree who walks through our doors. It’s assisting with tax planning and compliance on top of wealth management and introducing you to an insurance or mortgage broker to cover all your financial bases.

As a registered investment advisor representative with LPL Financial, we are fiduciaries with our advisory clients first, always acting in our clients’ best interest—we’re simply about helping you reach your goals with a customized plan that works for you, and all the people that matter to you.

Approachable.

Empowering.

Experienced.

Award Winning.1

Whether you’re embarking on a new career path, transitioning into retirement, or experiencing an unexpected life change, we’ve got you covered every step of the way.

Our Services

Investment Management

Design and maintain a customized investment portfolio that aligns with your holistic, goals-based financial plan.

Retirement Planning

Focus on retirement readiness to ensure financial independence later in life, wealth transfer, and philanthropy.

Tax Strategies

Align tax savvy strategies with your personal financial goals and business ventures to keep more of what you earn.

Estate & Gift Planning

Gain perspective and advice on how to manage your estate and safeguard your family’s assets to leave a lasting legacy.

Health & Life Insurances

Factor wellness into your overall financial plan to ensure that your strategy evolves as your life changes.

Inheritance Planning

Connect with an experienced advisor to help you sort out the financial and emotional complexities of receiving an inheritance after the loss of a loved one.